Blog

Tax deductions on home equity loans and mortgages have long benefited homeowners. These deductions allow homeowners to reduce their taxable income by…

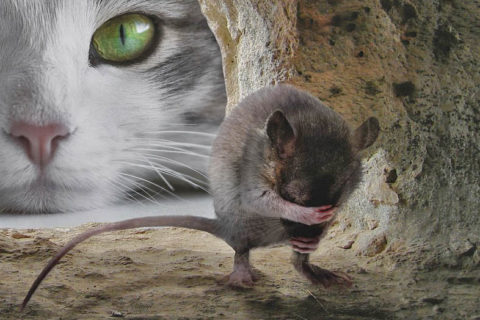

The best-laid plans of mice and taxpayers often go astray and leave both in a dark place with no easy way out. Without strategies, even sensible…

You just discovered a previous employer underreported Social Security wages and earnings and possibly made other errors. Now you worry that your…

The IRS is paying close attention to Bitcoin and cryptocurrency transactions and has sent letters to cryptocurrency users. A nice way to say, “We…

How the IRS interprets taxing rebates, points, and rewards can be confusing, at best. For example, your credit card rewards may be taxable income.…

Timber sale taxes are relatively obscure IRS and SALT taxes. These taxes apply to all taxpayers, whether they’re retired, aren’t business owners, or…

As adults, trust fund babies often face the limitations of complicated trust structures or find themselves the recipients of an incomprehensible…

Federally Declared Disaster designation laws and TCJA of 2017 make claiming casualty loss tax deductions impossible for some victims of fire, flood,…

The SECURE Act Retirement Bill, passed in the House on May 16, 2019, and expected to make it through the Senate this term follows closely on the…

2019 QBI deductions and 199A regulations and guidance implementing QBI Section 199A deduction were released by the IRS January 18, 2019, and on April…