New 2020 IRS W-4 Requires 2020 Vision

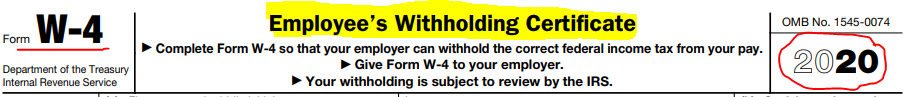

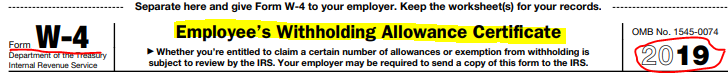

The new 2020 IRS W-4 contains major revisions that the IRS had been unable to put into effect for 2019. As required by the Tax Cuts and Jobs Act of 2017, the 2020 W-4 becomes the third W-4 structured to function under increasing control of the employee.

Updated December 11, 2019, to include Final 2020 W-4 info

This is NOT the year for DIY tax preparation

Things have changed.

Before the enactment of the TCJA, business owners, supervisors, and HR departments faithfully handed out new W-4s at year-end. Friendly reminders to fill out new W-4s often followed wedding and birth announcements. But not so in our post-TCJA world. The IRS tucks instructions on their website and employees try to decide when they should or shouldn’t switch to the 2020 W-4, remember to make required updates and hope they haven’t hoisted too many red flags.

Employees will soon feel the burden of responsibility as the effects of their decisions become blurred and hard to read. Even the W-4 name change is a bold statement and should have all taxpayers reaching for their 2020-vision-enhancing Mister Magoo Glasses before you start reading!

Why is the new 2020 IRS W-4 so different?

Presumably, to be less complicated and give employees more control. In the past, employees were required to submit a new W-4 each year, usually before December 31, even if there were no changes in their circumstances. But this new 2020 W-4 operates on a more-or-less “when and if you decide to use it” rule. Further, the IRS contends that this form has easier worksheets, straightforward questions and increases transparency and accuracy of withholdings.

However, the “when and if” rule isn’t as lenient as it might first appear. If the IRS disagrees with your answers to straightforward questions, penalties and interests could start piling up.

I strongly urge every taxpayer whose tax return or household includes income reported on a W-4 to carefully review the 2020 W-4 and all attached instructions before year-end. December 2019 is the time to take control and assume responsibility for your taxes.

Note: Consider making needed changes in December using the 2019 W-4. Then, in 2020, if and when you choose or are required, make changes on the 2020 W-4. Married? Spouses should discuss their tax goals and plans before submitting 2020 W-4s to their employers.

What’s so different about the new 2020 W-4?

Through November 2019, the new 2020 W-4 remained in second draft form. The IRS says no other substantive changes are anticipated, and employees and can begin 2020 tax and payroll planning based on the second draft.

Generally, beginning in 2020, employees must use the 2020 W-4 form if or when they:

- Begin a new job,

- or when changes to personal or financial situations would change the entries on the form.

Otherwise, the 2019 W-4, which the employer has been using in 2019, may continue to be used for withholding purposes in 2020. But, if an employee hired before 2020 wishes to adjust their withholding in 2020, the new 2020 W-4 must be used. If that employee does not submit the 2020 W-4, employers must continue to withhold based on the W-4 previously submitted.

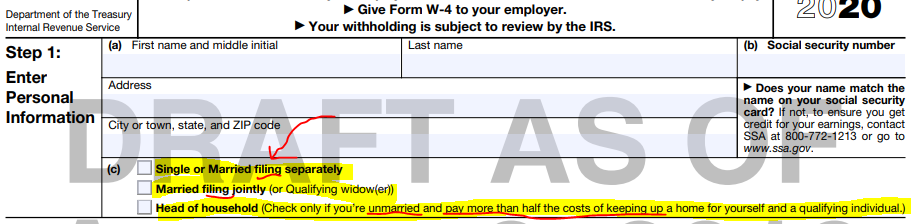

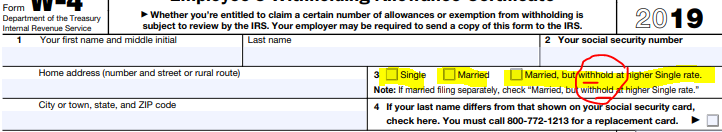

New 2020 IRS W-4 step-by-step

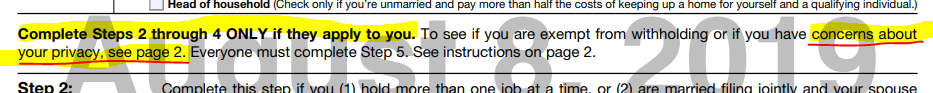

Steps 1 and 5 must be completed

If an employee fills out only these steps, withholding will be based on the standard deduction and tax rates, with no other adjustments.

Step 5 is for your signature and date signed.

Step 1 provides your first look at the way it was but now is. Notice that the 2020 W-4 asks for your filing status rather than the 2019 choice of withholding rate.

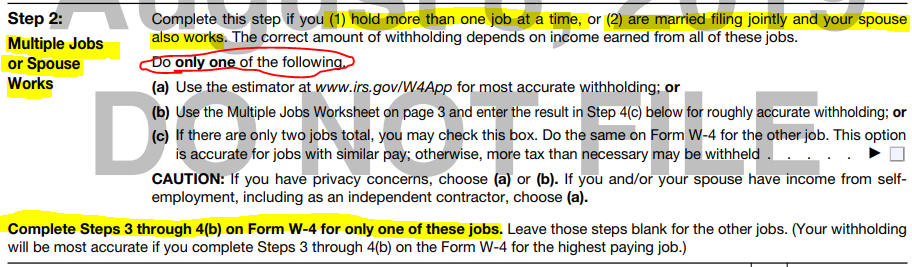

Step 2 reports your multiple jobs or spouse’s job

The IRS says to use Step 2 if you have more than one job at the same time or are married filing jointly, and you and your spouse both work.

Results will be more accurate if wages for the highest paying job are used, and the standard deduction and tax brackets will be divided equally between the two jobs.

Note: Many married couples file jointly, but maintain separate checking accounts and assume specific household payments and expenses. Consider the effects of increased withholdings on the wages of the lower-paid spouse.

Step 2(b) suggests you use their Estimator for the most accurate withholding.

Ready to start? Make sure Javascript is enabled.

![]()

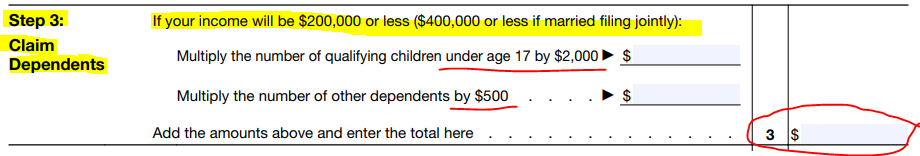

Step 3 allows you to claim dependents and other tax credits

This is where you claim deductions other than the standard deductions IF you itemize your return.

You can also include other tax credits in this step, such as education tax credits and the foreign tax credit. To do so, add an estimate of the amount for the year to your credits for dependents and enter the total amount in the circle.

Multiple job households: Complete Steps 3 through 4(b) on only one Form W-4 in the household. Withholding will be most accurate if you do this on the W-4 for the highest paying job. NOTE: Read the full Specific Instructions on the final draft, Page 2 of the new 2020 IRS W-4

Multiple job households: Complete Steps 3 through 4(b) on only one Form W-4 in the household. Withholding will be most accurate if you do this on the W-4 for the highest paying job. NOTE: Read the full Specific Instructions on the final draft, Page 2 of the new 2020 IRS W-4

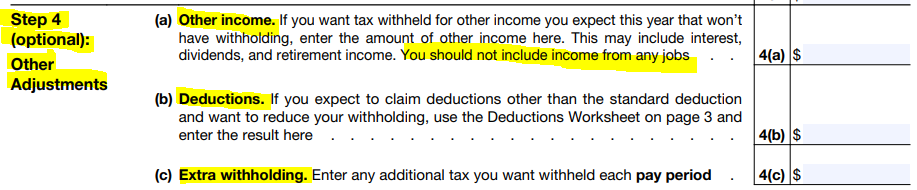

Step 4 allows for other adjustments

If you complete Step 4(a), you likely won’t have to make estimated tax payments for that income. If you prefer to pay the estimated tax, see Form 1040-ES, Estimated Tax for Individuals.

Use Step 4(b) if you expect to claim deductions other than the basic standard deduction. This includes both itemized deductions and other deductions, such as for student loan interest and IRAs.

Use Step 4(c) to enter any additional tax you want to be withheld from your pay each pay period. Entering an amount here will reduce your paycheck and will either increase your refund or reduce any amount of tax that you owe.

Privacy, transparency, and options.

You may have concerns about handing your boss or HR clerk a W-4 showing you have a second job and investment income. Understandable. When it comes to privacy and transparency, the IRS provides several options. Check out the IRS FAQs, specifically #13, for suggestions. However, keep in mind that a solution addressing any specific concern could have adverse effects in other areas. Always consider the overall results.

This is NOT the year for DIY tax preparation

Goals + PLAN + Strategies = SUCCESS $$

I earned my reputation as The Radical CPA

What’s the bottom line?

You can have the same opportunities as my clients have to control your financial future. I can become your CPA tax specialist and financial business and life goals adviser, and you can have the control you need and want.

Our goal is to become part of your overall life and business goal planning team so that you’ll be able to establish your own goals and know that you have a trusted professional on your side. We build and maintain a personal and business relationship with our clients. Your LIFE is your business, and your BUSINESS is your life. We’re here for YOU.

Call us at 479-478-6831 or you can email us.

To schedule an appointment with Melanie Radcliff, you may also use our Online Appointment Scheduling option!

You may also be interested in:

Taxes on rebates, points, and rewards. Yikes!

Have your W-4 earnings been reported correctly?

The IRS already knows about your Bitcoin

If you don’t control your taxes, the IRS will!