Opportunity Zones Map Your Way to Capital Gains Deferments

The Opportunity Zones tax initative is part of the TCJA of 2017, but the Opportunity Zones map wasn’t completed until June 6, 2018, when the states participating increased from covering parts of 18 states to covering parts of all 50 states, the District of Columbia and five U.S. territories. Opportunity Zones retain their designation for 10 years. Investors may defer tax on almost any capital gain up to Dec. 31, 2026 by making an appropriate investment in a zone, making an election after December 21, 2017, and meeting other requirements.

Proposed regulations and guidance for Investing in Qualified Opportunity Funds remains in draft form, already submitted to the Office of the Federal Register, and scheduled for public hearing January 10, 2019. The Treasury and IRS continue to work on additional published guidance, including additional proposed regulations to be published in the near future. The IRS also requests comments on additional issues which should be included “in forthcoming proposed regulations or guidance.”

Has any specific tax incentive ever offered as much with as many yet-to-be finalized regulations and guidelines? I would find that debatable.

Participation in Opportunity Funds is not an FIY project. Strategies that are put into motion with knowledge and experience produce fearless, flexible, quick-moving options that define your future success. That’s tax gaming; and this Tax Cuts and Jobs Act preferential tax incentive requires skillful tax gaming.

I know tax gaming. Let’s get your tax strategy game ready.

479-478-6831

Send an email

This multi-part series begins with a general overview of the Opportunity Zone tax incentive. If you have any questions or need immediate assistance relative to critical year-end decisions and options, contact me at 479-478-6831 or send an email.

General Overview

Who can take advantage of these new tax opportunities?

Business owners and well-heeled investors have a wide path to the creation of Opportunity Funds in which certain types of investments in Opportunity Zones receive preferential tax treatment. Loosely speaking, eligible taxpayers are those that recognize capital gain for Federal income tax purposes.

These taxpayers include individuals, C corporations (including regulated investment companies and real estate investment trusts), partnerships, and certain other pass-through entities, including common trust funds, qualified settlement funds, disputed ownership funds, and other entities.

Investment options in Opportunity Funds

The draft regulations and guidance for investing begins with “that to qualify, or be an eligible interest in a Qualified Opportunity Fund, an investment in the QOF must be an equity interest in the QOF, including preferred stock or a partnership interest with special allocations.”

Opportunity Funds are designed to be responsive to the needs of the Zone. Some of the options available to Funds include ability to:

- invest in or purchase the stock of a company if substantially all of it’s tangible property is and remains located in the Zone,

- take interests in partnerships that meet the same criteria,

- invest in real estate or infrastructure

- make substantial improvement of property (full guidance not yet released on improvement test)

No money is being appropriated for Opportunity Funds and there are no caps on investments. At the end of 2017 U.S. households held an estimated $3.8 trillion of unrealized capital gains in stocks and mutual funds alone, and corporations another $2.3 trillion. That’s a lot of opportunity for investement and community growth.

The 180-Day Rule

When does it begin?

When does capital gain not provide a specific date?

Why is Treasury and IRS asking if exceptions or additions should be made?

Opportunity Zones qualified designation expires in 10 years.

Basis step-up election preserved until December 31, 2047. Could be.

How do you propose to benefit or change mid-stream? Ask me.

Send an email

479-478-6831

Opportunity Zones map out your target properties

In June, 2018, the U.S. Treasury Secretary certified the final population census tracts nominated by the governor of every U.S. state (selected by CEOs of each state) and territory and the mayor of Washington, D.C. For the next ten years, private investors, through Qualified Opportunity Zones will be eligible for certain preferential tax benefits in return for investing in these low-income zones. Specific Opportunity Zones are identified by their 11-digit census tract numbers using the U.S. Census Bureau’s Geocoder. Selected tracts have high need as well as proven growth potential.

Opportunity Zones map your strategy

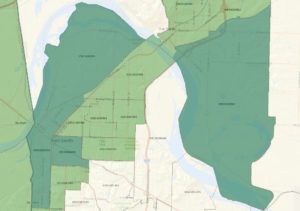

Opportunity Zones, which follow population census tracts, are shown in dark green in these Snips from the Opportunity Zones map link provided below at the end of this blog article.

Northwest Arkansas: Sebastian and Crawford Counties:

Sebastian and Crawford Counties:

Click here for IRS Bulletin 2018-28 dated July 9 listing all states and counties with population census tracts designated as Opportunity Zones. States are broken down by counties in which Opportunity Zones exist.

What else?

Next In Series Blog Topic

The Race to OZ: Finding the Starting Gate

The real estate and property development market is already in a rush and moving forward in what looks like a stampede. Certain criteria must be met almost immediately in order to get the most benefit out of this preferential tax opportunity. The fact that final guidance, forms and details have yet to be ironed out require that investor strategies are optimized for quick, flexible adjustments. This is tax gaming, tax avoidance, keeping your own money and never leaving anything on the table for the IRS.

Bottom Line

I know and understand the fine art of tax gaming and that tax avoidance is when my client stands firmly, toes to the line, on the regulations that the IRS has established.

You can have the same opportunities as my clients have to control your own financial future. I can become your CPA tax specialist and financial business and life goals adviser and you can have the control you need and demand.

Call us at 479-668-0082. Use my Calendly Page (it’s easy) to set an appointment or you can email us.

I’ve earned my reputation as The Radical CPA

Investing in Qualified Opportunity Funds (Proposed Rules)

Tax Gaming is Highly Complicated but worth it!